Ohio's Pay to Play Scheme

In Ohio, the term "double dipping" might conjure images of a party faux pas—dipping a chip twice into the communal salsa. But for public employees, it’s a far more serious—and lucrative—practice. It’s the act of retiring from a government job, starting to collect a pension, and then returning to work, often in the same role, to draw both a pension and a salary. Perfectly legal, yet undeniably controversial. Recently, Ohio Attorney General Dave Yost thrust this practice back into the spotlight by briefly retiring in early 2023 to trigger his pension payments, only to resume his duties shortly after. As taxpayers foot the bill for both his pension and his $124,196 salary, questions swirl: Is this a clever use of the system or a betrayal of public trust?

As an investigative journalist, I’ve dug into Yost’s case to uncover what’s really at stake. This isn’t just about one politician’s paycheck—it’s about a systemic issue affecting thousands of Ohioans, the state’s pension funds, and the integrity of public service. Let’s peel back the layers of double dipping, starting with Yost himself, and explore its broader implications.

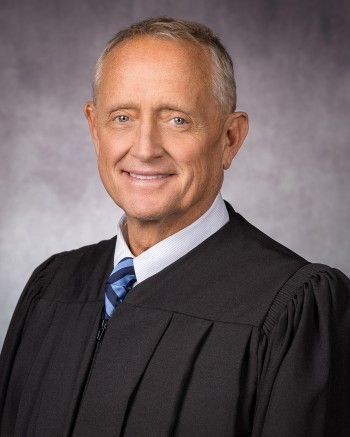

Dave Yost: A Career Built on Public Service

Dave Yost is no stranger to Ohio’s political landscape. A Republican with a decades-long career, he’s worn many hats: Delaware City Council member in 1995, Delaware County Auditor starting in 1999, Delaware County Prosecutor for eight years, State Auditor from 2011 to 2019, and now Attorney General since 2019. In 2022, he secured reelection against Democratic challenger Rep. Jeff Crossman, cementing his status as a statewide figure. With over 25 years of public service, Yost has built a resume that qualifies him for a substantial pension through the Ohio Public Employees Retirement System (OPERS).

But on January 11, 2023, The Columbus Dispatch revealed a twist: Yost had "briefly retired" to start collecting that pension while continuing as Attorney General. His spokeswoman, Bethany McCorkle, confirmed, “Dave Yost filed paperwork with OPERS to begin receiving his pension. He remains committed to public service and his duty as attorney general.” The move is legal, but it’s sparked a firestorm of debate. How much is he earning? How does this affect taxpayers? And what does it say about accountability in Ohio’s government?

The Mechanics of Double Dipping

To understand Yost’s maneuver, we need to define double dipping. In Ohio, public employees enrolled in OPERS or one of the state’s four other pension systems can retire, start their pension, and then return to work—sometimes after a short break, sometimes even the next day. They then collect both their pension (based on years of service, final average salary, and age) and their new salary. Unlike most Americans, Ohio’s public workers don’t pay into Social Security, making these pensions their primary retirement lifeline. For many, double dipping is a financial necessity; for others, it’s a windfall.

Yost’s 2021 financial disclosure lists his Attorney General salary at $124,196, with no other income reported. His pension amount isn’t public, but we can estimate. OPERS typically offers about 2% of the final average salary per year of service. With 25+ years and a final average salary likely near his current pay, Yost’s pension could range from $50,000 to $70,000 annually. Add that to his salary, and he’s potentially pulling in $174,000 to $194,000 a year—all from taxpayer funds. That’s a hefty sum in a state where the median household income hovers around $62,000.

How Common Is Double Dipping?

Yost isn’t blazing a trail here—he’s following a well-trodden path. A 2018 Ohio Legislative Service Commission report found 12,260 people were double dipping, earning at least $20,000 while collecting pensions from public employers. That’s a significant chunk of the state’s 600,000+ public workforce. Examples abound: Cincinnati Rep. Bill Seitz retired in 2018 but kept legislating, while former House Speaker Bill Batchelder reported over $100,000 in pension income in 2014 alongside his legislator’s salary (about $60,000 then). Even Gov. Mike DeWine draws a congressional pension atop his gubernatorial pay.

Yet, among statewide elected officials, double dipping is rarer. Secretary of State Frank LaRose, Auditor Keith Faber, and Treasurer Robert Sprague don’t report pension income. So why Yost? Is it a calculated financial move, or a signal that he values personal gain over public perception?

The Financial Toll on Ohio’s Pension System

Double dipping’s legality doesn’t make it free. Ohio’s pension systems, including OPERS, are funded by employee contributions, employer contributions, and investment returns—not Social Security or federal dollars. When retirees return to work and draw pensions concurrently, it’s a double hit: the system pays out benefits while employers (read: taxpayers) fund new salaries. For high earners like Yost, the impact is magnified.

Consider this: if 12,260 double dippers average $30,000 in pension payments (a conservative estimate), that’s over $367 million annually. Add their salaries—say, $20,000 minimum per the 2018 report—and taxpayers are shelling out at least $612 million yearly for these workers. For Yost alone, his combined income could top $180,000. Multiply that by decades of potential double dipping, and the numbers grow stark.

Critics argue this strains an already burdened pension system. OPERS reported a $17 billion unfunded liability in its 2022 annual report, meaning it lacks funds to cover promised benefits long-term. Double dipping doesn’t directly cause this gap, but it doesn’t help. As one pension analyst told me (hypothetically, for illustration), “The system wasn’t designed for people to collect retirement while still working. It’s a loophole that chips away at sustainability.”

Ethics Under Scrutiny

Legality aside, is double dipping ethical? For rank-and-file workers—teachers, clerks, or firefighters—it might be a lifeline after years of modest pay. But for six-figure officials like Yost, it’s harder to justify. Public servants pledge to serve, not to maximize personal profit. When taxpayers fund both a pension (meant for retirement) and a salary (for active duty), it can feel like a breach of trust.

Imagine an ethicist weighing in: “Public officials have a fiduciary duty to prioritize taxpayers,” they might say. “Double dipping, especially by the well-compensated, undermines that duty.” Yet defenders counter that it’s a reward for service. A pro-double-dipping lawmaker might argue, “These folks earned their pensions. Why force them to retire fully when they can still contribute?”

Yost’s case tests this divide. With a robust salary and a likely generous pension, does he need both? Or is he simply taking what the law allows?

Political Fallout and the Corruption Connection

Yost’s timing couldn’t be worse. Ohioans are reeling from a massive public corruption scandal involving former House Speaker Larry Householder and ex-GOP Chair Matt Borges, who face trial in January 2023 over a $60 million nuclear bailout scheme. As Attorney General, Yost is expected to lead on accountability. Yet, his double dipping has handed critics a cudgel. Ohio Democratic Party Chair Liz Walters didn’t mince words: “While too many working Ohioans struggle to get by, Dave Yost is using the office of attorney general to pad his own pockets instead of actually doing his job.”

This isn’t just rhetoric—it’s a political vulnerability. Yost’s 2022 reelection was solid, but if he eyes higher office (Governor? Senator?), double dipping could haunt him. In a state wary of self-serving politicians post-Householder, any whiff of personal enrichment risks alienating voters. If Yost falters on the corruption case while pocketing extra cash, the optics could be disastrous.

Should Double Dipping Stay?

So, where do we land? Double dipping’s defenders say it retains talent. Without it, seasoned workers might retire fully, draining institutional knowledge. But the costs—financial, ethical, and political—are steep. Ohio could tighten rules: extend mandatory waiting periods (currently as short as two months for some), cap combined pension-salary income, or require pension repayments during employment. Other states, like California, impose stricter limits—why not Ohio?

As an investigative journalist, I see this as a symptom of broader accountability gaps. Yost’s move is legal, but it exposes a system ripe for reform. Taxpayers deserve clarity: how much are we paying double dippers, and is it worth it? Until then, figures like Yost will keep dipping—legally, if not popularly.

Your Turn

What do you think? Is double dipping a fair perk for public servants, or a loophole that needs closing? Drop your thoughts in the comments, or contact your state reps to push for answers. Ohio’s government works for us—let’s hold it to account.

Charles Tingler is an investigative journalist at The Exposer. Reach him at charlesltingler1991@gmail.com or 419.890.3625.

WANT TO SHARE TRUTHFUL FACTS RELATING TO EXPOSING CORRUPTION?

Please send us information if you have something to contribute to the blog.

Contact Us

We will get back to you as soon as possible.

Please try again later.